21+ Fha loan credit score

Ad Eased Requirements Make Qualifying For Lower Rates A Snap. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

N1812 Oak Ridge Avenue Merrill Wi 54452 Home For Sale Mls 22202742 Shorewest Realtors

Or if you can only put 35 percent down youll need a score of 580 or higher.

. Loan amounts can go up to 42068000 for single family residence. If your credit score is 580 or above then you can finance with a 30-year FHA. Understand the Requirements of an FHA Loan There are some specific requirements that youll need to meet in order to qualify for an FHA loan.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Your credit situation has changed. Apply Get Pre-Approved In Minutes.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. FHA loans require borrowers to have a credit score of 580 or better. Down payment requirements.

Todays 10 Best FHA Loans Comparison. Its recommended you have a credit score of 620 or higher when you apply for a conventional loan. However in order for.

If your score is below 620. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Some require 640 or higher.

Applicants with a better credit rating increase their options for mortgage or refinance loans. With a minimum credit score of 580 borrowers can be approved with a down payment as low as 35 saving a considerable amount over. For a conventional loan it is 620.

In this particular case the readers middle FICO score would not meet the requirements of a lender requiring a 620 FICO score as the middle FICO. In order to qualify for the low 35 percent FHA loan down payment applicants will need a FICO. A smaller percentage of loans went to borrowers with credit scores within the 550 599 range.

55 21 votes FHA loans are mortgages backed by the US. Borrowers with a FICO. See if you qualify for lower interest rates.

Smaller down payment required. Fha Loans Texas Credit Score - If you are looking for options for lower your payments then we can provide you with solutions. Ad Find FHA Loan Rates Terms That Fit Your Needs.

Down payments for FHA loans are 35 at least. Minimum of 35 down payment. Must have a minimum FICO credit score of 500 to 579 if you plan to put 10 percent down.

Save Money With FHA Loan - A Loan With Rates As Low As 35 Easy Qualification. Ad FHA eligibility requirements. Apply Today Save.

Youll need to hold off. You can still get an FHA loan if your credit score is between 500-579 but your down payment. Apply Get Pre Approved.

This is because lenders want to make sure that borrowers are financially stable enough to pay off a. Depending on your credit score lenders that issue FHA loans typically charge interest rates that are anywhere from 05 to 15 higher than those available. Ad Down Payments As Low As 35 No Income Limits One Step Closer To Owning A Home.

FHA loans have more lenient credit score requirements. The minimum credit score for an FHA loan with a 35 down payment is 580. Compare Quotes See What You Could Save.

30 20 25 15 and 10 year loans. Dont Waist Extra Money. You obtained a fixed-rate FHA loan before or during the 2008 housing crisis and your interest rate is sufficiently higher than current rates.

For conventional loans it is typically. Ad Lock Your Rate Before Rates Increase. Texas comparison fha fha in texas apply for fha texas fha.

FHA Loans Benefit Homebuyers With Less Than Perfect Credit. On a scale of 300 to 850 youll need a credit score of at least 500 to qualify for FHA financing. How much of a down payment youll need to purchase a home with an FHA loan depends on your credit score.

A home buyer can qualify for FHA Loans with credit scores as low as 500 credit scores. 455 19 votes Conventional Loan Requirements. Ad Find Mortgage Lenders Suitable for Your Budget.

The authors have written thousands of blogs specific to FHA mortgages and the site has substantially increased readership over the years and has become known for its FHA. The minimum credit score for an FHA loan is 500. Ad Eased Requirements Make Qualifying For Lower Rates A Snap.

Compare Quotes Now from Top Lenders. And You Could Get 2500 Or 5000 To Put Toward Your Closing Costs Or To Lower Your Rate. Get Your Best Interest Rate for Your Mortgage Loan.

HUD Agency Credit Score Guidelines HUD the parent of the Federal Housing Administration The FHA requires a minimum credit score of 500 FICO. According to Ellie Mae 124 of total FHA loans in December fell into this lower tier.

Budget Proposal Template 2 Marketing Budget Template The Best Marketing Budget Template For 2017 For You Making Budget Template Marketing Budget Budgeting

Payment Agreement Contract Template Lettering

Where To Find Value Add Investing Opportunities American Association Of Private Lenders

2

Earn Extra Cash 21 Ways To Add 150 To Your Budget Life And A Budget Budgeting Earn Extra Cash Extra Cash

Calculator Rebar Capital Llc

Where To Find Value Add Investing Opportunities American Association Of Private Lenders

Is Buying A House A Good Investment Forbes Advisor

Debbie Hecht Thoughts Theories

2

The Home Loan Expert Mortgage Home Loans Mortgage Refinance

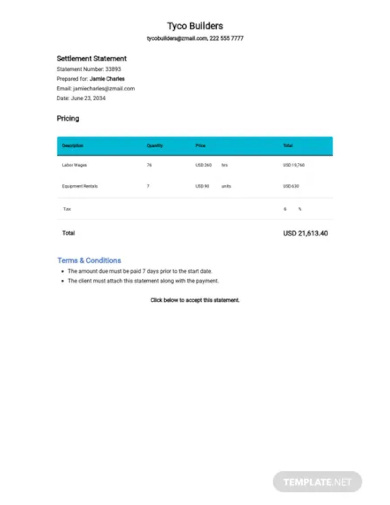

Free 10 Settlement Statement Samples Mortgage Conference Real Estate

The Home Loan Expert Mortgage Home Loans Mortgage Refinance

/bank21-5c1189c946e0fb0001890ef8.jpg)

Land Loans 3 Things To Consider Before Buying

The Reminder May 3 9 2022 By Beacon Communications Issuu

2

115441 County Road N Edgar Wi 54426 Home For Sale Mls 22201444 Shorewest Realtors